It is important to verify that the person you are hiring as a bookkeeper contractor has the correct qualifications. If you hire someone with no experience or minimal training, you are not promoting your business. It is important to hire someone with at least a bachelor's degree and experience in bookkeeping.

Independent contractor

As an independent bookkeeper contractor, you'll be handling business transactions, and you may have to perform accounting and bookkeeping tasks. Bookkeeping is the system of recording all business transactions, and the outcome of these transactions is recorded in accounts. Bookkeeping is easy and can be done by independent contractors. Popular options include Freshbooks, Wave and QuickBooks Online. These software applications can be used in all types of small businesses. In some cases, an accountant can be contacted.

You are an independent bookkeeper contractor and must maintain accurate books for tax reporting purposes. Accurate records allow you to quickly pay your taxes and get back on track. Additionally, accurate books can reduce the time you spend in meetings with your accountant. Having accurate records can also boost your productivity and help your business run smoothly.

Contract

Before a bookkeeper is allowed to start working for your company, they must sign a written agreement with you. The contract should have standard language about the nonemployer relationship, indemnity and dispute resolution procedures. The contract may need additional language or be modified depending on where your residence is. An asset statement for tangible and intangible assets should be included in a good bookkeeper contract.

A performance clause should be included in the contract that requires the Bookkeeper perform bookkeeping services in accordance with the National Tax Preparers Association's standards. The contract should also specify the bookkeeper's role as an independent contractor, so that you know exactly what they are responsible for.

Rate

The type of work that you are doing and your experience can affect the rates for bookkeepers. For example, a bookkeeper who has been doing the same job for over ten years might charge considerably more than someone who just started doing it. You might also be able to charge more for additional training or specialization in certain areas of the business.

There are many advantages to hiring a bookkeeper. However, there are some things to be aware of before you hire one. First, consider the overhead involved. Each bookkeeper contractor is different in terms of overhead costs. For example, some might have an office and a fleet of fifty service vehicles.

Qualifications

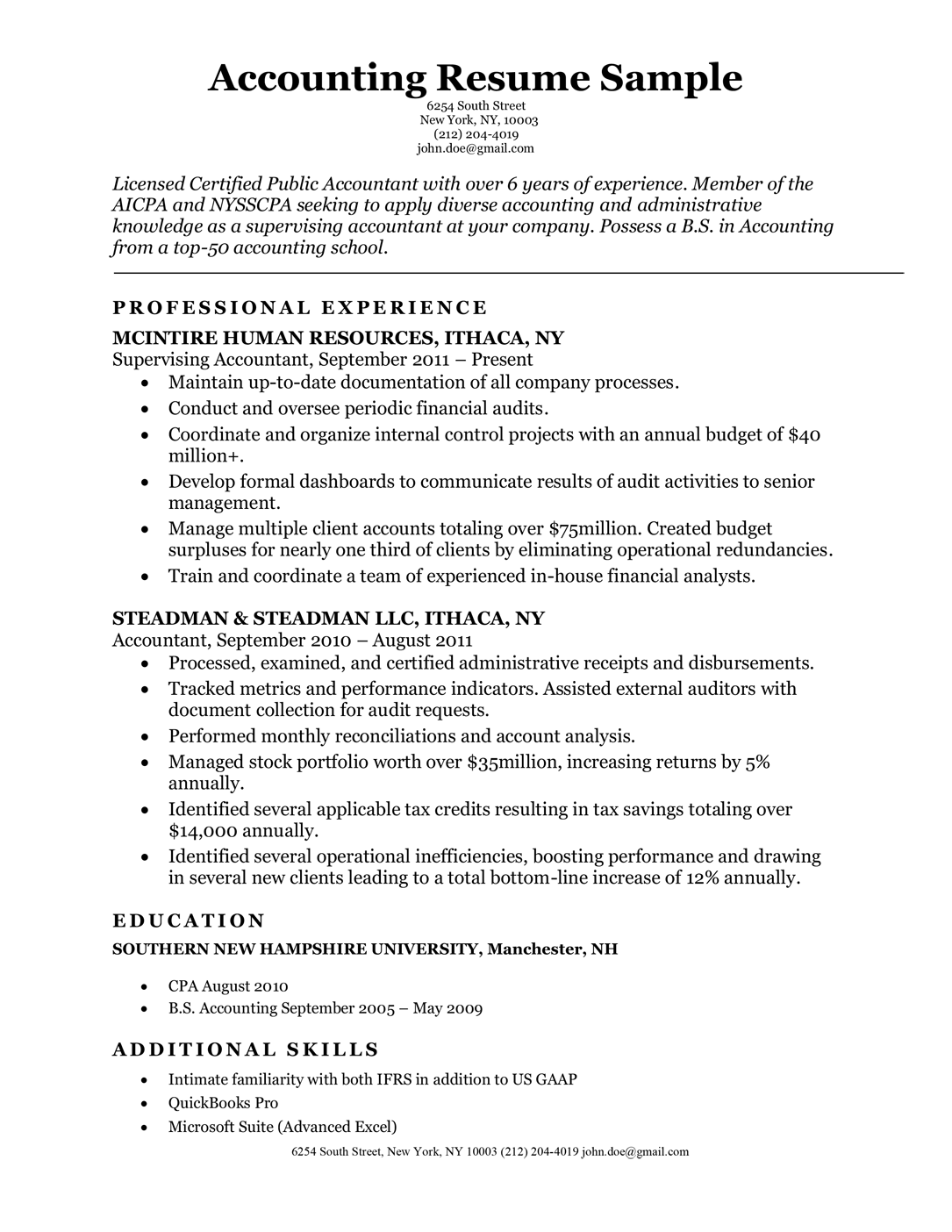

When hiring a contractor for bookkeeping, it is crucial to verify that they have the appropriate qualifications and experience. Bookkeepers must communicate clearly and efficiently financial information verbally and written. They need to be organized and able use their time effectively.

Many bookkeeper contractors have a bachelor's degree or higher, although some are highly qualified even without a college degree. Some bookkeepers are members of organizations such the Association of Certified Public Bookkeepers. The organization requires additional training, including in finance and accounting. Business owners may request specific experience related to their type or bookkeeping.

Work from home

If you're an experienced accountant, bookkeeper, or other accounting professional, you may want to consider a part-time virtual position. You can help small business thrive without having to make long commutes or work more than 50 hours per week. As a bonus, you can work from home. You can start by reading our five-day bookkeeping starter guide.

It is important to be able to do the job well before you begin your bookkeeping career. You will need to be able to pay attention and have a solid knowledge of accounting and bookkeeping. Access to a company server and reliable internet access are also essential. In addition, you'll need to be familiar with spreadsheets and bookkeeping software. Apart from being an accountant you can also provide operational support to small-scale businesses.

FAQ

What should I look for in an accountant's hiring decision?

Ask about their qualifications, experience, and references when interviewing an accountant.

You need someone who has done it before and is familiar with the process.

Ask them if they have any knowledge or skills that might be useful to you.

Make sure that they are well-respected in the local community.

How do I start keeping books?

To start keeping books, you will need some things. These items include a notebook and pencils, calculator, staplers, envelopes, stamps and a filing drawer or desk drawer.

How much do accountants make?

Yes, accountants can be paid hourly.

Complicated financial statements can be a charge for some accountants.

Sometimes accountants will be hired to complete specific tasks. An example of this is a public relations firm that might hire an accountant for a report on how the client is doing.

What is the significance of bookkeeping and accounting

Bookkeeping and accounting is essential for any business. They are essential for any business to keep track and monitor all transactions.

These items will also ensure that you don't spend too much on unnecessary items.

You need to know how much profit you've made from each sale. It's also necessary to know your responsibilities to others.

You can raise your prices if you don’t have enough cash coming in. But, raising prices too high could result in customers being turned away.

Sell any inventory that you don't need.

You might be able to cut down on certain services and products if your resources are less than what you require.

All of these factors will impact your bottom line.

Why is reconciliation so important?

It's very important because you never know when mistakes happen. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can have serious consequences such as inaccurate financial statements, missed deadlines and overspending.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

External Links

How To

Accounting for Small Businesses: How to Do It

Accounting is an essential part of managing any business. This includes tracking income and expenses, preparing financial statements, and paying taxes. This task also requires the use of software programs, such as Quickbooks Online. There are several ways to do small business accounting. You need to choose the most appropriate method for your business. Below are the top choices.

-

Use the paper accounting method. If you want to keep things simple, then using paper accounting may work well for you. It is easy to use this method. All you have to do is record your transactions every day. However, if you want to make sure that your records are complete and accurate, then you might want to invest in an accounting program like QuickBooks Online.

-

Use online accounting. Online accounting makes it easy to access your accounts anywhere, anytime. Some popular options include Xero, Freshbooks, and Wave Systems. These software can be used to manage your finances, pay bills and send invoices. You can also generate reports. They have many great features and are very easy to use. These programs can help you save time and money on accounting.

-

Use cloud accounting. Cloud accounting is another option. You can store your data securely on a remote server. Cloud accounting has many advantages when compared to traditional accounting software. Cloud accounting does not require that you purchase expensive software or hardware. Your information is kept remotely and offers you better security. It saves you the hassle of backing up your data. It also makes it easier to share your files.

-

Use bookkeeping software. Bookkeeping software is similar in function to cloud accounting. You will need to purchase a computer and then install the software. After you install the software, you'll be able connect to the internet and access your accounts whenever you wish. You will also be able view your balance sheets and accounts directly from your computer.

-

Use spreadsheets. Spreadsheets can be used to manually enter financial transactions. One example is a spreadsheet you can use to track your daily sales. Another good thing about using a spreadsheet is that you can change them whenever you want without needing to update the entire document.

-

Use a cash book. A cashbook allows you to record every transaction. Cashbooks can come in different sizes depending on how much space is available. You can choose to use separate notebooks for each months or one notebook that spans multiple years.

-

Use a check register. A check register is a tool that helps you organize receipts and payments. Simply scan your items into your scanner to transfer them to the check register. Notes can be added to the items once they are scanned.

-

Use a journal. A journal is a type of logbook that keeps track of your expenses. If you have many recurring expenses, such as rent, insurance, or utilities, this journal is the best.

-

Use a diary. A diary is simply a journal that you write to yourself. You can use it as a way to keep track and plan your spending habits.