What are the objectives of accounting? Accounting can determine the financial viability of a business. An accounting procedure provides useful information to its intended users. These users use the information to make investment decisions and financial forecasts. Here are a few examples. Here are some common uses for accounting. You can read more about accounting. Before you continue, let's first understand the importance of accounting.

Accounting is the language used in business

According to Mason, Davidson, and Scinder, accounting is the language of business. Financial statements, reports, and other financial information tell the story for any company, country, or industry. These documents provide information about revenue and expenses, debt vs. revenues, and costs associated with retaining customers. This information is essential to make informed decisions. But accounting can help businesses make informed business decisions if they are well-informed.

Financial records are known as the language and history of business. Executives consider financial statements an essential part their job. These documents are essential for anyone who wants to communicate in the business world. This language is universally applicable and necessary to be a successful businessman. Accounting is the language of business. However it is not just one language. Accounting is required by all businesses.

It assists in capital allocation decision making

Capital Asset Allocation (CA), is designed to increase shareholder values over the long term. CA is used to make investments in the business, buy intangibles, and trade in mispriced security. The goal is to maximise return on investment and reduce risk. Investors who are savvy focus on the investment decisions made and their impact. They take into account many factors, such as their ability to invest in the company and its assets.

Financial reporting is essential for capital allocation decisions. Because financial reporting attracts capital capital, it is a crucial tool for decision-making. Inadequate financial information can adversely impact the securities markets and cause capital allocation decisions to be made. Furthermore, financial information is valuable to management as it can be used for performance incentives, and for maintaining certain positions. Accounting is critical for capital allocation decisions. Some people remain skeptical about accounting's importance in capital allocation.

It is useful in financial forecasting

Businesses cannot grow and remain profitable without financial forecasts. Businesses can make accurate financial forecasts in order to plan for future growth and attract investors. A strong financial plan also allows companies to negotiate better office leases and properly size insurance coverage. An important component of a solid financial plan is accounting. Below are some ways accounting can be used to help financial forecasting. These three factors are key to helping businesses increase their profit margins.

Net working capital: This is the difference of current assets and future liabilities. Net working capital can be projected using historical data. Two years of historical financial information is the best practice. The past net working capital figures can be used to help project the future. When creating a financial forecast, remember to include all assumptions in the plan. Without a base to build upon, it is difficult to create a forecasted financial plan.

It is a key factor in determining profitability

For an enterprise to determine its profitability, the decision-makers need accurate and reliable data that allows them to make informed decisions. Also, owners should have an accurate understanding of all costs associated with creating a product or service. This includes fixed and variable costs. These aren't affected by seasonality and don’t depend on labor volume. Cost accounting can help reduce expenditures and increase profitability. We will be discussing in the following paragraphs how accounting can assist businesses in determining their profitability.

As a business owner, your goal should be to increase profits. Your success as a leader in the C-suite or executive director is dependent on your ability to determine profitability. Profitability is the primary source of motivation for any company, so it is important to know how to evaluate profitability. The key to measuring profitability is cost accounting, a management tool that evaluates all costs associated with producing a product or service. Among its other functions, cost accounting measures fixed and variable expenses associated with production.

It helps in calculating taxes

On an ongoing basis, companies must pay sales and payroll taxes. These taxes are levied at the local, national and state levels. Accounting standards are crucial in determining the right tax rate. Businesses can reduce their income taxes and ensure that they only pay the right tax rate by using accounting standards. Accounting can help you calculate taxes through many different processes including sales tax, income tax, and employment taxes.

Accounting for income tax can help businesses increase profits and reduce tax liability. Companies may only be subject to one tax in some countries, while companies can claim input tax credits for raw material. No matter where a company is located, income tax accounting can help companies reduce their tax liability and ultimately lead to higher profits. Companies are also required to maintain two sets of books of accounts, which adds to their compliance costs.

FAQ

How can I find out if my business needs an accountant

When a company reaches a certain size, accountants are often hired. For example, a company needs one when it has $10 million in annual sales or more.

Many companies employ accountants regardless of size. These include small companies, sole proprietorships as well partnerships and corporations.

It doesn't really matter how big a company is. Accounting systems are the only thing that matters.

If it does, then the accountant is needed. And it won't.

What is the distinction between a CPA & Chartered Accountant, and how can you tell?

A chartered accountant is a professional accountant who has passed the exams required to obtain the designation. Chartered accountants have more experience than CPAs.

Chartered accountants are also qualified to offer tax advice.

A chartered accountancy course takes 6-7 years to complete.

What should I expect from an accountant when I hire them?

Ask questions about the qualifications and experience of an accountant when you are looking to hire them.

You need someone who is experienced in this type of work and can explain the steps.

Ask them if they have any special skills or knowledge that would be helpful to you.

Make sure they have a good name in the community.

What does an accountant do, and why is it so important?

An accountant keeps track of all the money you earn and spend. They track how much you pay in taxes and what deductions you are allowed to make.

An accountant will help you manage your finances, keeping track of both your incomes as well as your expenses.

They can prepare financial reports both for individuals and companies.

Accounting professionals are required because they need to be able to understand all aspects of the numbers.

A professional accountant can also help with taxes, so that people pay as little tax as they possibly can.

What is the difference in accounting and bookkeeping?

Accounting is the study and analysis of financial transactions. These transactions are recorded in bookkeeping.

They are both related, but different activities.

Accounting deals primarily in numbers while bookkeeping deals with people.

To report on an organization's financial situation, bookkeepers will keep financial information.

They ensure that all the books are balanced by correcting entries for accounts payable, accounts receivable or payroll.

Accounting professionals examine financial statements to determine if they are in compliance with generally accepted accounting principles.

If they don't, they might suggest changes to GAAP.

Bookkeepers keep records of financial transactions so that the data can be analyzed by accountants.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

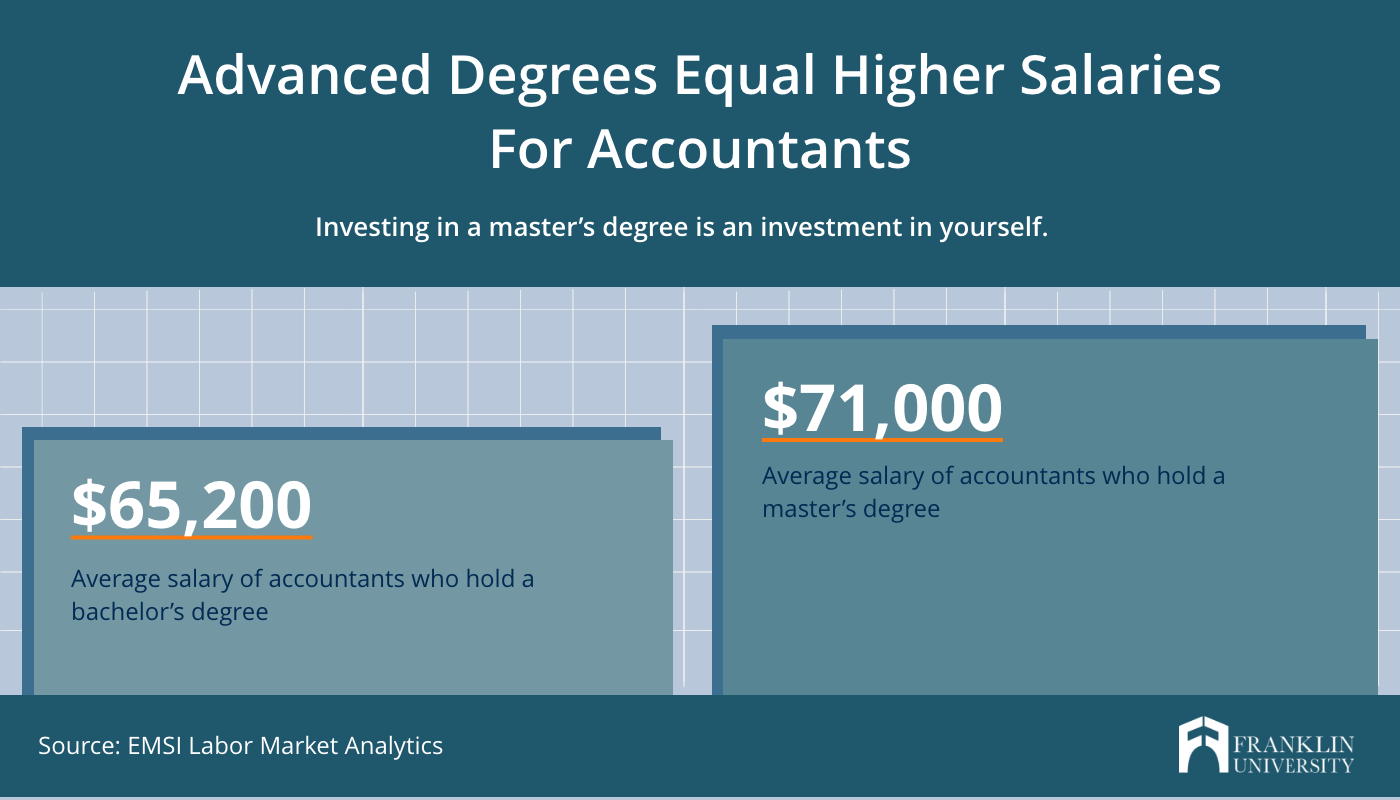

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

External Links

How To

How to get an accounting degree

Accounting is the art of keeping track and recording financial transactions. It records transactions made by individuals, governments, and businesses. The term account refers to bookskeeping records. These data are used by accountants to create reports that help companies or organizations make decisions.

There are two types: general (or corporate) and managerial accounting. General accounting is concerned with the measurement and reporting of business performance. Management accounting is about measuring, analyzing and managing resources within organizations.

Accounting bachelor's degrees prepare students to become entry-level accountants. Graduates can also opt to specialize in areas such as auditing, taxation or finance management.

For students interested in pursuing a career of accounting, they should be able to understand basic economic concepts such as supply/demand, cost-benefit analysis (MBT), marginal utility theory, consumer behavior and price elasticity of demand. They should also be able to understand macroeconomics, microeconomics and accounting principles as well as various accounting software packages.

For students to pursue a Master's in Accounting, they must have completed at minimum six semesters of college courses including Microeconomic Theory; Macroeconomic Theory and International Trade; Business Economics. Graduate Level Examination must be passed by students. This exam is typically taken after three years of study.

Candidates must complete four years in undergraduate and four years in postgraduate studies to become certified public accountants. Candidats must take additional exams to be eligible for registration.